How Many Bedrooms Are Best For A UK Investment Property? Maximizing Rental Yields

Property investors in the UK are enjoying average annual rental yields of approximately 4.75%, as reported by Property Data. In cities like Manchester and Birmingham, yields can soar above 6%, making them attractive investment destinations. However, when it comes to maximizing returns, which types of apartments prove to be the most lucrative?

This article aims to analyze the advantages and considerations associated with different property sizes, shedding light on important factors to help investors make informed decisions regarding their UK buy-to-let property investments.

Determining the rental yield a property can generate involves various factors, making it impossible to prescribe a one-size-fits-all answer regarding the ideal number of bedrooms. Studios, one-bedroom, two-bedroom, and three-bedroom apartments all offer potential for strong returns. The choice ultimately depends on factors such as budget, personal preferences for rental properties, and the target rental market.

Investors interested in studios should consider the benefits of lower purchase prices and potentially lower maintenance costs. These compact units often appeal to young professionals and students seeking affordable, conveniently located accommodation.

One-bedroom apartments present a balance between affordability and rental demand. They attract a broad tenant base, including young professionals, couples, and single individuals, making them a reliable choice for consistent rental income.

Two-bedroom apartments can offer versatility and increased rental returns. These units are popular among small families, couples sharing accommodation, and professionals seeking a home office space. The potential for higher rental income makes them an attractive option for investors willing to allocate a larger budget.

For investors with a greater budget and a focus on targeting families or professionals in need of more space, three-bedroom apartments can be an excellent choice. These properties often command higher rental prices and appeal to long-term tenants, providing stability and potentially higher returns.

In addition to property size, other factors should be carefully considered before finalizing a buy-to-let investment decision. Location, rental market demand, local amenities, transport links, and potential rental appreciation should all be thoroughly researched and evaluated.

Ultimately, successful property investment requires a thorough understanding of personal investment goals, budget constraints, and the dynamics of the rental market. By carefully weighing the advantages and considerations of each property size, investors can make informed decisions that align with their investment strategy and maximize rental yields.

Keep in mind that consulting with experienced property investment advisors, such as our team at Magnate Asset, can provide valuable insights and guidance tailored to your specific investment objectives. Together, we can navigate the UK buy-to-let market and identify the most promising opportunities for your portfolio.

Choosing the right buy-to-let investment

The key with any buy-to-let property investment is understanding your target demographic and delivering on their needs. Not only do you need to think about the number of bedrooms, but also the area in which you’re investing. You should consider how many bedrooms the local rental market is crying out for, as well as what type of tenant you’d like to attract.

For example, if your rental property is located in a prime city centre like Manchester or Birmingham, you might want to capitalise on the rising demand for two-bedroom properties, due to a growing trend of young professionals, graduates and friends sharing an apartment. On the other hand, a family home in an area with good schools can command higher rents if it has more than two or three bedrooms.

Manchester

Based on JLL’s 5-year rental growth forecasts, Manchester is leading all UK cities with projected growth of 21.6%, meaning if you bought a property in Manchester today, you could expect an average annual rental yield of more than 5%. Paired with the city’s 5-year sales forecast, the value of your property would appreciate by 19.3% by 2027. This is an average based on all apartment property types.

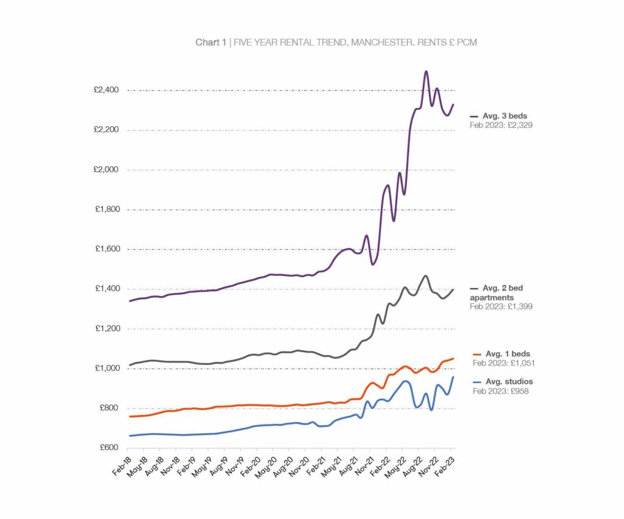

Urbanbubble’s Manchester report gives a breakdown of achieved rents across all apartment types from February 2018 – February 2023. While the graph doesn’t disclose yields, it demonstrates that rents have risen significantly across all apartment types in the last year. There are signs of a correction taking place in the market, particularly for 3 bed apartments, which saw the largest increases over the five-year period. The property type seeing the strongest consistent yields are 2-beds – a trend expected to continue.

Five-year rental trend, Manchester, Rents £ PCM

Source: Urbanbubble, Rental Market Report, February 2023

Birmingham

Based on JLL’s 5-year rental growth forecasts, Birmingham is also expected to outperform most other UK cities, with 19.3% rental growth forecast by 2027. Meaning if you bought a property in Birmingham today, you could expect an average yield of more than 4% per year for the next five years. Paired with the city’s 5-year sales forecast, the value of your property would appreciate by 19.2% by 2027, according to JLL. Once again, this is an average across all apartment types.

Studio Apartments vs. 1 Bedroom Apartments

A studio apartment combines all the elements of an apartment – a living area, bedroom area and kitchen area – into one space with no inner walls other than a separate bathroom. Purchase price varies significantly depending on the location, size and development but purpose-built studios are typically anywhere between £110,000 and £240,000 in prime city centre locations like Manchester (Zoopla, April 2023).

A 1-bedroom apartment on the other hand, is an apartment that contains a separate bedroom, kitchen/living area and bathroom (sometimes two bathrooms). Offering more space and generally appealing to a wider tenant demographic, 1-beds in Manchester city centre are currently priced anywhere between £130,000 and £380,000 for prime stock. It is worth noting that investing in these higher-end properties does pay off, as prime developments offering high-demand amenities attracts wealthier renters who are willing to pay a premium.

Advantages of investing in a studio apartment

- Lowest capital entry point

- A smaller property is easier and cheaper to furnish

- Appeal to students, graduates and single occupants

- Strong yields in prime city centres

- Shortage in the market

- Affordable option to enter the property ladder

- Low maintenance

- Less council tax than multiple-room properties (although this is paid by the tenant)

Advantages of investing in a 1-bed apartment

- Still low capital entry point (not that much higher than studios)

- Affordable to furnish

- Appeals to wider rental market – couples, young professionals, graduates

- Achieves higher monthly rents

- Higher capital appreciation

- Fewer void periods – seen as a longer term rental home than studio

- More space and privacy

- Could be used as a second home for investor in the future

- Low maintenance

- Easier to sell than studios (exit strategy)

When comparing studios vs. 1-bed apartments for investment purposes, 1 bedroom properties are widely accepted as the better investment opportunity. While studios make great first-time buy to let investments thanks to their affordability and low maintenance, their lack of space and privacy mean that they tend to be seen as shorter term rental homes and therefore have more void periods.

For example, studios typically appeal to graduates or young people moving to the city, looking to keep rents as low as possible while they settle in. An ideal start-up home, tenants usually outgrow their studios after a year and seek more space or move in with a friend or partner. Void periods can mean lower returns and more tenancy management costs.

1-Bedroom Apartments vs. 2-Bedroom Apartments

1-beds make excellent first-time investments as they require a lower capital entry point than properties with more bedrooms and still yield strong returns. Especially in a branded development in a prime city centre, with high-demand amenities, floor-to-ceiling windows and services such as concierge and 24-7 security. These factors can drive up yields significantly and increase the average length of tenancy contracts.

However, for investors with the capital to invest, we’d recommend a 2-bedroom apartment due to their huge demand in the UK market and strong returns in the form of rental yields and capital appreciation. They are also more desirable to owner occupiers as well as investors, so are typically easier to sell when you decide to exit.

Advantages of investing in a 1-bed apartment

- Lower capital entry point compared to a 2-bed

- Cheaper and easier to furnish than a 2-bed property

- Lower maintenance

- Appeals to young professionals and graduates living alone, as well as couples

- Council tax is less than a 2-bed property (although this is paid by the tenant)

- Good first-time investment

Advantages of investing in a 2-bed apartment

- More space – priority of renters post-pandemic (JLL)

- More pet-friendly

- Still lower maintenance than a house or 3-bed

- Drive higher rents than 1-beds

- Appeals to widest demographic – friends sharing, young professionals cohabiting, couples needing office space, young families

- In huge demand due to people sharing (growing trend of people sharing to save on energy bills)

- Seen as a longer term rental home – renters tend to stay longer

- Zoopla states that 2-beds are the highest yielding apartment size (average national yield of 5.16%)

- Ground rent and service charge costs the same whether it’s a 1-bed or 2-bed

- Easier to sell than 1-bed apartment (more desirable property to owner occupiers rather than just investors)

Today, 2-bedroom apartments are the most popular investment choice within the prime build-to-rent sector. This is largely down to their appeal to a wide rental demographic, including friends sharing, young professionals cohabiting, and couples looking for a spare bedroom or office space.

This 2-bed sharing trend is also correlational with a move towards prime city centre stock. In JLL’s recently published Big Six Residential Report, it was reported that despite the UK’s heightened cost of living, renters are choosing prime quality developments in city centre locations, defying economic conditions. Partly due to the higher Energy Performance Certificate (EPC) ratings of city-centre new builds, meaning energy bills are lower for renters, tenants are willing to pay a premium for higher quality homes with better amenities.

1-Bedroom vs. 2-Bedroom – 5-Year Forecast example

Below is a 5-year forecast example, comparing the financial projections of a 1-bed and a 2-bed apartment in our most prestigious Manchester development to date, One Port Street. Completing in Q4 2025, the forecasts include capital growth projections over the build period. Off-plan investments are another great way to maximise returns, as you can secure the property at the lowest possible price, use a payment plan, and benefit from capital appreciation over the build period.

1-Bed: 5-Year Financial Forecast Example

Based on a 1-bedroom property within One Port Street, priced at £315,000:

|

Investment forecast |

Over build |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

|

Capital Appreciation |

£352,800 |

£366,912 |

£381,588 |

£396,852 |

£412,726 |

£429,235 |

|

|

12% |

4% |

4% |

4% |

4% |

4% |

|

Rental Income |

|

£18,900 |

£19,057 |

£19,215 |

£19,372 |

£19,530 |

|

Rental Yield Per Annum |

|

6.00% |

6.05% |

6.10% |

6.15% |

6.20% |

|

|

|

|

|

|

|

|

|

Total Capital Appreciation |

£114,235 |

|

|

|

Total Return |

£210,309 |

|

Total Rent |

£96,074 |

|

|

|

5-Year ROI |

67% |

*Please note, this is a financial forecast and is subject to change.

2-Bed: 5-Year Financial Forecast Example

Based on a 2-bedroom property within One Port Street, priced at £464,532:

|

Investment forecast |

Over build |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

|

Capital Appreciation |

£520,275 |

£541,086 |

£562,729 |

£585,238 |

£608,647 |

£632,992 |

|

|

12% |

4% |

4% |

4% |

4% |

4% |

|

Rental Income |

|

£27,871 |

£28,104 |

£28,336 |

£28,568 |

£28,800 |

|

Rental Yield Per Annum |

|

6.00% |

6.05% |

6.10% |

6.15% |

6.20% |

|

|

|

|

|

|

|

|

|

Total Capital Appreciation |

£168,460 |

|

|

|

Total Return |

£310,139 |

|

Total Rent |

£141,679 |

|

|

|

5-Year ROI |

67% |

*Please note, this is a financial forecast and is subject to change.

2-bedroom apartments vs. 3-bedroom apartments

Due to their size and increased occupancy potential, 3-beds can drive strong rental yields, giving investors a healthy stream of cash flow each month. But when it comes to investment property, bigger isn’t always better.

3-bedroom apartments are in much shorter supply than 1 and 2-beds. Depending on the local market, this can be a positive as your returns are underpinned by supply and demand. However, you could be limiting your target market.

Advantages of investing in a 2-bed

- Appeal to widest rental market compared to 3-bed

- In higher demand – can mean fewer void periods

- Typically stronger yields as 3-beds are more expensive

- More affordable than a 3-bed property or a house

- Appeal to more owner occupiers – easier exit strategy

- Longer term rental home

- Not as much maintenance as 3-bed

- Lower furnishing costs than a 3-bed

- Appeals to widest market – couples wanting office space, young professionals sharing, young families, friends sharing, aspirational renter wanting spare bedroom or office space

- Pets are a priority – people want more space for pets (cats, dogs)

- More storage

Advantages of investing in a 3-bed

- More space, privacy and storage – priority of renters post-pandemic

- Appeal to friends sharing

- Appeal to students, graduates and families

- Seen as a longer term rental home if families live there

- They are a niche in the market, meaning you can charge more rent per person

- Higher rents than all other apartment types

- Additional bathrooms

- Appeals to widest market – couples wanting office space, young professionals sharing, young families, friends sharing, aspirational renter wanting spare bedroom or office space

- More pet-friendly – priority of Millennials and Gen-Z

In conclusion, there are many variables determining the rental yield a property can offer, meaning there is no one-size-fits-all answer on how many bedrooms are best for maximum returns. As discussed, the right property type for you will largely depend on your investment strategy and factors such as – your budget, goals, personal preferences, location, target rental market and local demand.

With all factors taken into consideration, we believe 2 bedroom properties are the most high-demand investment choice due to their appeal to the widest rental market. Savvy investors who achieve a balance of strong capital gains and high rental yields have a diverse portfolio of different property sizes, types and locations.

To summarise, the key factors underpinning a successful residential investment are:

- Location – prime city centres

- Amenities – high-demand amenities such as communal workspace, cafes, gyms, cinema rooms

- Catering to your target demographic

- Choosing a reputable developer with a proven track record

- Choosing an off-plan development to purchase at the lowest possible price and maximise returns

- Community – choose a branded residence that prioritises resident experience and community

- Pet-friendly policy – Don’t limit your rental market by closing off pets.

Contact us today to hear more about how UK property can work for you.

Magnate Assets is the largest independent property portal for overseas buyers, we make finding your ideal UK property effortless. Our portal covers every aspect of UK property investment and has a wealth of confidential, off-market units only available through Magnate Assets.

Popular Blogs

-

.jpg?length=100&name=Email%20(25).jpg) Rising Foreign Ownership: Why Overseas Investors Are Turning to UK Property

Rising Foreign Ownership: Why Overseas Investors Are Turning to UK Property

-

London's Most Expensive Residential Postcodes: Where Are They?

London's Most Expensive Residential Postcodes: Where Are They?

-

UK Bank Interest Rates Projection for 2025-2026: What Property Investors Need to Know

UK Bank Interest Rates Projection for 2025-2026: What Property Investors Need to Know

-

The Foreign Location with the Most UK Property Owners Revealed

The Foreign Location with the Most UK Property Owners Revealed

-

.png?length=100&name=Email%20(28).png) UK Student Accommodation Booms as 2025 Investment Surges

UK Student Accommodation Booms as 2025 Investment Surges

-

.jpg?length=100&name=Email%20(23).jpg) Interest Rates Could Drop to 2.5% by 2027: What It Means for UK Property Investors

Interest Rates Could Drop to 2.5% by 2027: What It Means for UK Property Investors

-

Why UK Property Investment is Thriving: 7.4% Average Yield in Q1 2025

Why UK Property Investment is Thriving: 7.4% Average Yield in Q1 2025

-

.jpg?length=100&name=Email%20(37).jpg) UK Property Market Sees Impressive Capital Appreciation Over 25 Years

UK Property Market Sees Impressive Capital Appreciation Over 25 Years

-

The Bright Future of UK Property Investment: Why Rising House Prices Signal Opportunity

The Bright Future of UK Property Investment: Why Rising House Prices Signal Opportunity

-

.jpg?length=100&name=Email%20(21).jpg) Savills' 2025 Real Estate Insights: Growth, Stability, and Investment Trends

Savills' 2025 Real Estate Insights: Growth, Stability, and Investment Trends

Blog Subscription

Related Articles

North-South Rent Gap Narrows in the UK: What It Means for Property Investors

For years, the UK property market has been marked by a distinct disparity in rental prices between...Birmingham’s Growing Potential for Property Investment: A City Poised for Growth

The Birmingham property market continues to strengthen its position as one of the UK’s most...Topics:

Insider, London Property, UK Property, Real Estate Market, Market Trends, Rents, Demand, Yield.png?width=512&height=512&name=whatsapp%20(2).png)