UK Housing Market Proves to be ‘Remarkably Robust’ as 70% of all Listed Properties are Sold

Close to 70% of all properties listed for sale in the first quarter of this year have sold, new figures show.

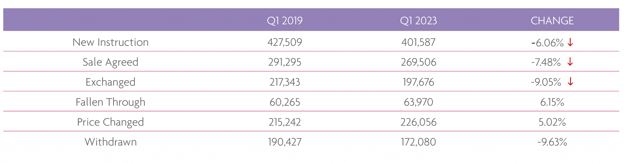

The latest research from TwentyCi reveals Q1 2023 saw 269,000 residential sales and nearly 70% of all properties listed in Q1 have sold so far in 2023. New Instructions are down on the quarter, but this disguises a significant injection of new supply into the market in March.

Sales agreed and exchanges are also lower, but based on March activity, the property market could be on an upward trend. Fall throughs, price changes and withdrawals have all increased, but remain remarkably low considering the unprecedented coincidence of economic and geo-political shocks.

Volumes are only marginally down in Q1 2023 when compared to 2019. Significantly, nearly 70% of all properties listed have sold so far in 2023, in an environment where prices are still 24% above pre-pandemic levels. In other words, most properties are selling and at prices which have locked in gains since 2019.

Colin Bradshaw, CEO at TwentyCi, said: “Our Q1 2023 report provides a comparison with 2019 which is widely considered to be the last period in which normal market conditions operated. The intervening period is peppered with quantum shocks including the rollercoaster of the pandemic; the fiscal policy changes effected through the Stamp Duty holiday; monetary policy pushing up interest rates to tackle inflation; and the short, but damaging tenure of Liz Truss as Prime Minister.

“Many media commentators would have us believe the property market is in free fall. Whilst the level of transactions and price increases is not matching the volumes or inflation seen in the last three years, a re-calibration was always likely.

“In reality the property market has demonstrated a robust performance against significant and determined headwinds.”

Sales by Region & Major Cities

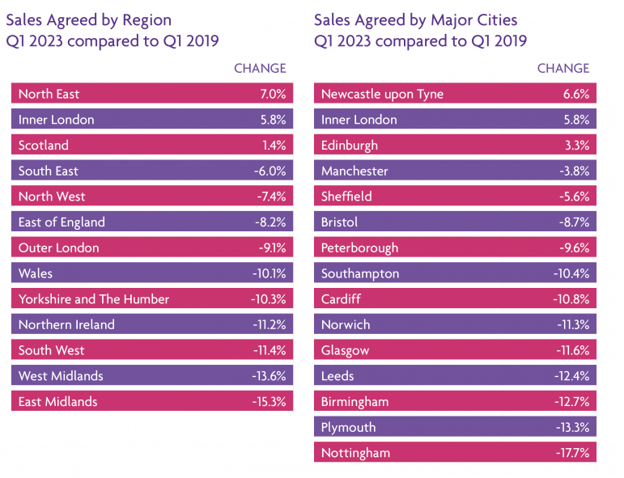

Sales agreed across the whole of the UK were on average 7.5% lower in Q1 2023, compared to Q1 2019. It is a broad picture across the regions and cities, with only the North East, Inner London and Scotland avoiding negative numbers.

Bradshaw continued: “Inner London was the region slowest to recover post-pandemic, but is now proving to be the most robust. Strong US dollar supports foreign investors seeking pricing opportunities and the trend to remote working has reversed somewhat, and urban centres once again become popular.

“The South East is the powerhouse and bellwether of the UK property market, so the 6% fall speaks to the headwinds endured recently. That said, these results are not clear evidence of a market in freefall and the transactions reflect a return to more normal market conditions.”

The average asking price across the UK has remained stable at £420,000, and although off the peaks recorded in Q2 2022, this represents an increase of 24% compared to 2019.

All regions have increased over the period, but not all have benefitted equally, with gains varying between 11.8% in Inner London to 32% in Wales. The imprint of the flight to rural and remote is still visible in these numbers, where changes to working practices caused by the pandemic prompted a demand for increased home space. This consequently led to a spike in demand for properties further away from cities and traditional commuter belts. This trend is waning, however, as will be seen in the sales volumes.

A picture containing map Description automatically generated

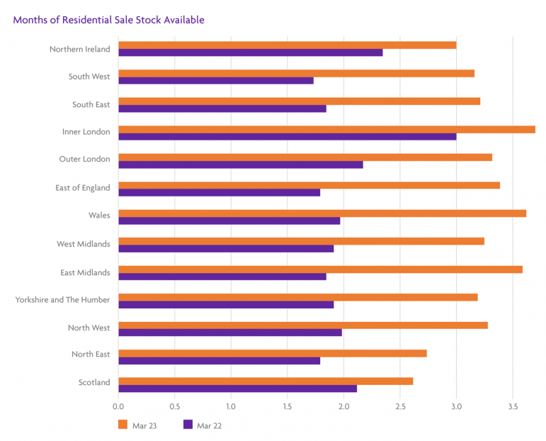

Despite a fall in Instructions, almost all regions in England and Wales have three or more months of residential stock to sell and levels are now only 9% away from historical norms. This is a significant improvement on 2021, when fiscal and monetary policy had driven excess demand and created record stock lows.

Bradshaw added: “As the dust settles from recent shocks, the residential market is emerging as remarkably robust. With energy costs easing and the potential for a sharp and protracted recession recedes, consumer confidence is likely to return. Should inflation also begin to slide, the prospect of interest rate reductions will also support market momentum.

“Whilst doomsday scenarios can’t be ruled out, it seems there is room for that old phrase -cautious optimism. As energy prices ease and interest rates and inflation look set to be near peaks or trending downwards, stable or upside scenarios have certainly started to look more credible.”

Popular Blogs

-

.jpg?length=100&name=Email%20(25).jpg) Rising Foreign Ownership: Why Overseas Investors Are Turning to UK Property

Rising Foreign Ownership: Why Overseas Investors Are Turning to UK Property

-

London's Most Expensive Residential Postcodes: Where Are They?

London's Most Expensive Residential Postcodes: Where Are They?

-

UK Bank Interest Rates Projection for 2025-2026: What Property Investors Need to Know

UK Bank Interest Rates Projection for 2025-2026: What Property Investors Need to Know

-

The Foreign Location with the Most UK Property Owners Revealed

The Foreign Location with the Most UK Property Owners Revealed

-

.png?length=100&name=Email%20(28).png) UK Student Accommodation Booms as 2025 Investment Surges

UK Student Accommodation Booms as 2025 Investment Surges

-

.jpg?length=100&name=Email%20(21).jpg) Savills' 2025 Real Estate Insights: Growth, Stability, and Investment Trends

Savills' 2025 Real Estate Insights: Growth, Stability, and Investment Trends

-

The Bright Future of UK Property Investment: Why Rising House Prices Signal Opportunity

The Bright Future of UK Property Investment: Why Rising House Prices Signal Opportunity

-

.jpg?length=100&name=Email%20(23).jpg) Interest Rates Could Drop to 2.5% by 2027: What It Means for UK Property Investors

Interest Rates Could Drop to 2.5% by 2027: What It Means for UK Property Investors

-

Why UK Property Investment is Thriving: 7.4% Average Yield in Q1 2025

Why UK Property Investment is Thriving: 7.4% Average Yield in Q1 2025

-

.jpg?length=100&name=Email%20(37).jpg) UK Property Market Sees Impressive Capital Appreciation Over 25 Years

UK Property Market Sees Impressive Capital Appreciation Over 25 Years

.png?width=512&height=512&name=whatsapp%20(2).png)